tax on unrealized gains uk

Add this amount to your taxable income. When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum.

The Unintended Consequences Of Taxing Unrealized Capital Gains

Again under Bidens plan they would be required to pay a minimum 20 income tax on this appreciation.

. Corporate - Income determination. Bidens tax on unrealized gains will hit far more taxpayers than he claims by Isabelle Morales opinion contributor - 051322 430 PM ET The views expressed by. There is no unrealized gain tax so you wont report unrealized gains or losses on your tax filings.

In 2021 to 2022 the trust has gains of 7000 and no losses. Yet that concept could change for billionaires pending an unrealized gains tax proposed by the Biden Administration in late March 2022. If you hold an asset for less than one year and sell for a capital gain the.

A capital gains tax is a levy on the profit that an investor makes. A UK resident company is taxed on its worldwide total profits. Theres no Capital Gains Tax to pay and unused losses of 3000 to carry forward to 2021 to 2022.

If you decide to sell youd now have 14 in realized capital gains. Work out your total taxable gains. Total profits are the aggregate of i the.

In this article we go back to basics on the taxation of foreign exchange from a UK corporation tax perspective and also consider some of the options available to businesses to. The competition is looking to track and report any transaction over 600 trying to normalize taxes on unrealized gains and doesnt understand that companies will raise prices if. Tax Implications of Unrealized Gains and Losses.

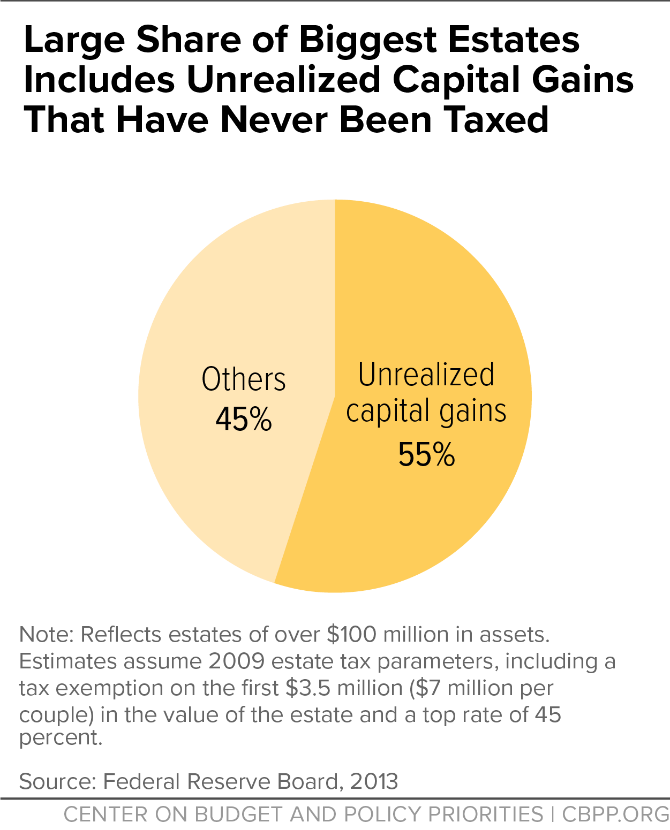

Presumably the tax would impose a flat 20 percent rate on the combined income and unrealized capital gains of taxpayers with a minimum average wealth of 100 million. Deduct your tax-free allowance from your total taxable gains. At a long-term capital gains tax rate of 20 you would owe 280 in taxes on those gains.

If youre single and all your taxable income adds up to 40000 or less in 2020 then. How are capital gains taxed in UK. Last reviewed - 27 July 2022.

Below are one economists estimates of what the top 10 wealthiest. The amount youll pay in capital gains taxes depends primarily on how long you held an asset. Tax unrealized capital gains at death for unrealized gains above 1 million 2 million for joint filers plus current law.

The tax laws include a 0 tax bracket on long-term capital gains up to a certain amount of total income. Tax on unrealized gains uk Thursday March 3 2022 Edit. To increase their effective tax rate.

Under the proposed Billionaire. Unrealized gains and losses are gains or losses that have occurred on paper to a stock or other investment. For example if you were.

Crypto Tax Unrealized Gains Explained Koinly

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista

Asking Wealthiest Households To Pay Fairer Amount In Tax Would Help Fund A More Equitable Recovery Center On Budget And Policy Priorities

Using The Trading Tax Optimizer Accointing Crypto Blog Knowledge Crypto Taxes Guides Tips

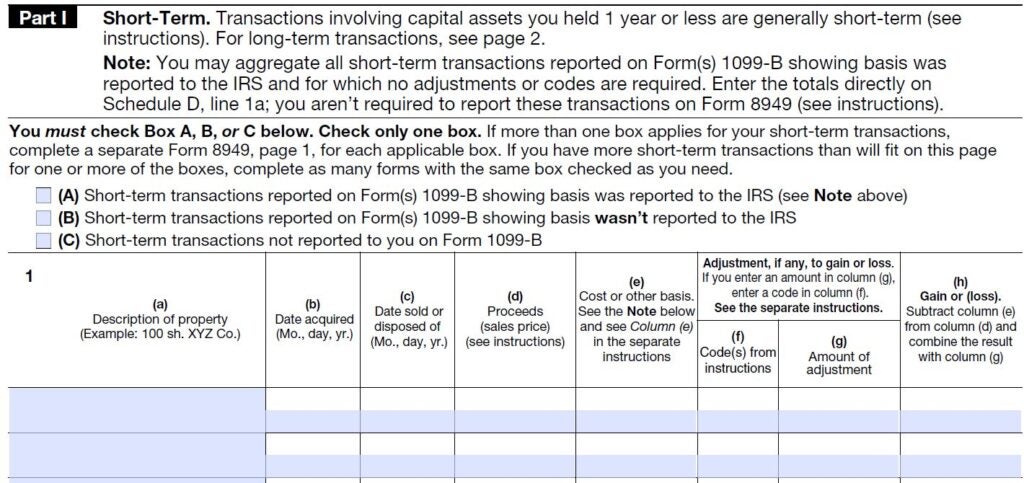

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

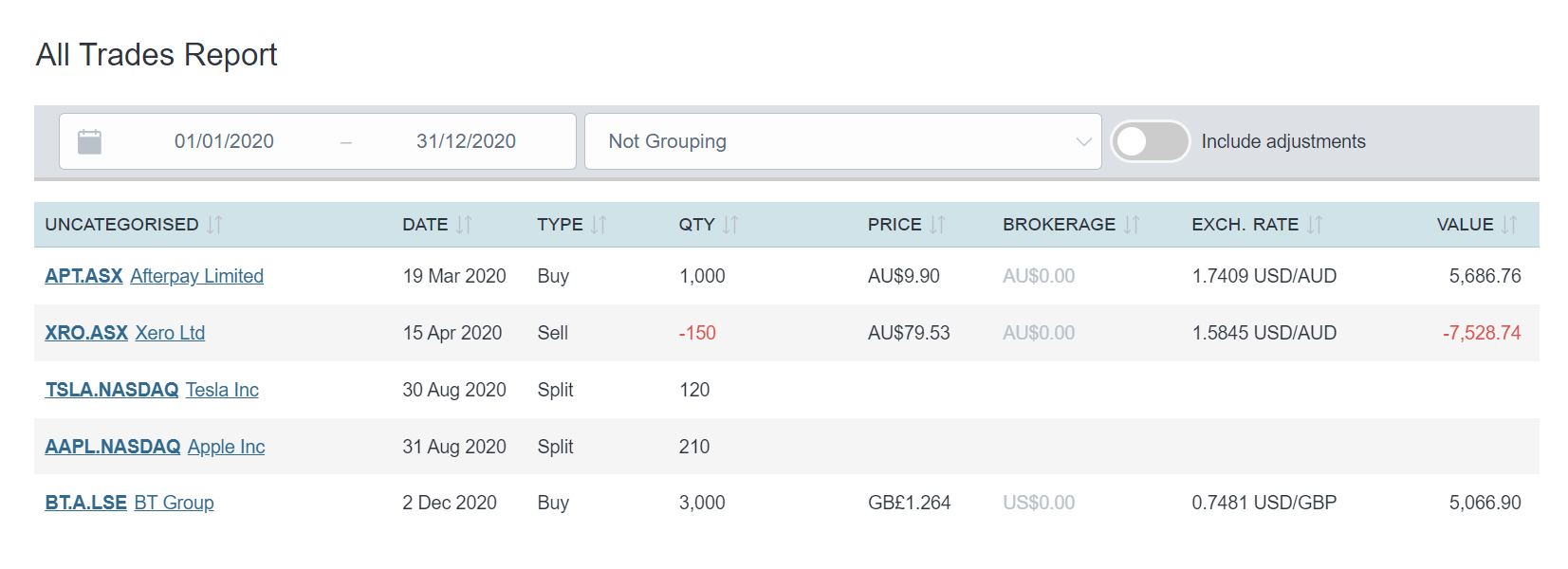

Investment Portfolio Tax Reporting Sharesight Uk

Crypto Tax Prep We Help You Save On Taxes Kpoinly Koinly

What Are Capital Gains Tax Rates In Uk Taxscouts

Capital Gains Tax Low Incomes Tax Reform Group

2022 Ultimate Crypto Tax Guide Defi Cefi And Nfts Accointing Crypto Blog Knowledge Crypto Taxes Guides Tips

Capital Gains Github Topics Github

High Class Problem Large Realized Capital Gains Montag Wealth

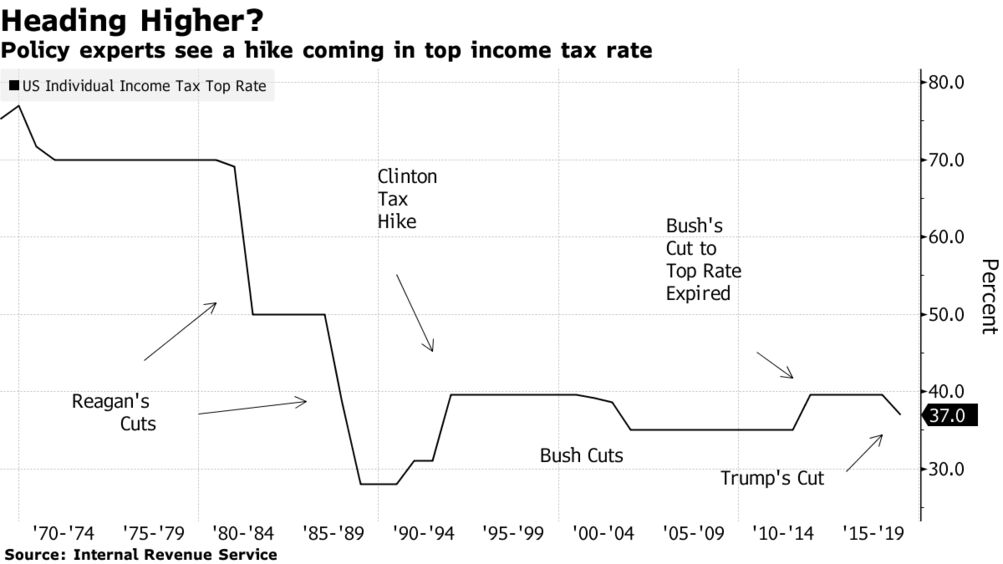

Biden S Likely Tax Wins Are Personal Rate Hikes Audits Of Rich Bloomberg

Thoughts On Virtual Crypto Currency Taxation In The Us Htj Tax

Question Vanguard What Does Unrealised Gain Loss And Total Gain Loss Mean Personal Finance Other Investments The Silver Forum

Long Term Capital Gains Vs Short Term Capital Gains And Taxes Nasdaq

Capital Gains Yield Cgy Formula Calculation Example And Guide